Optimize and

save more

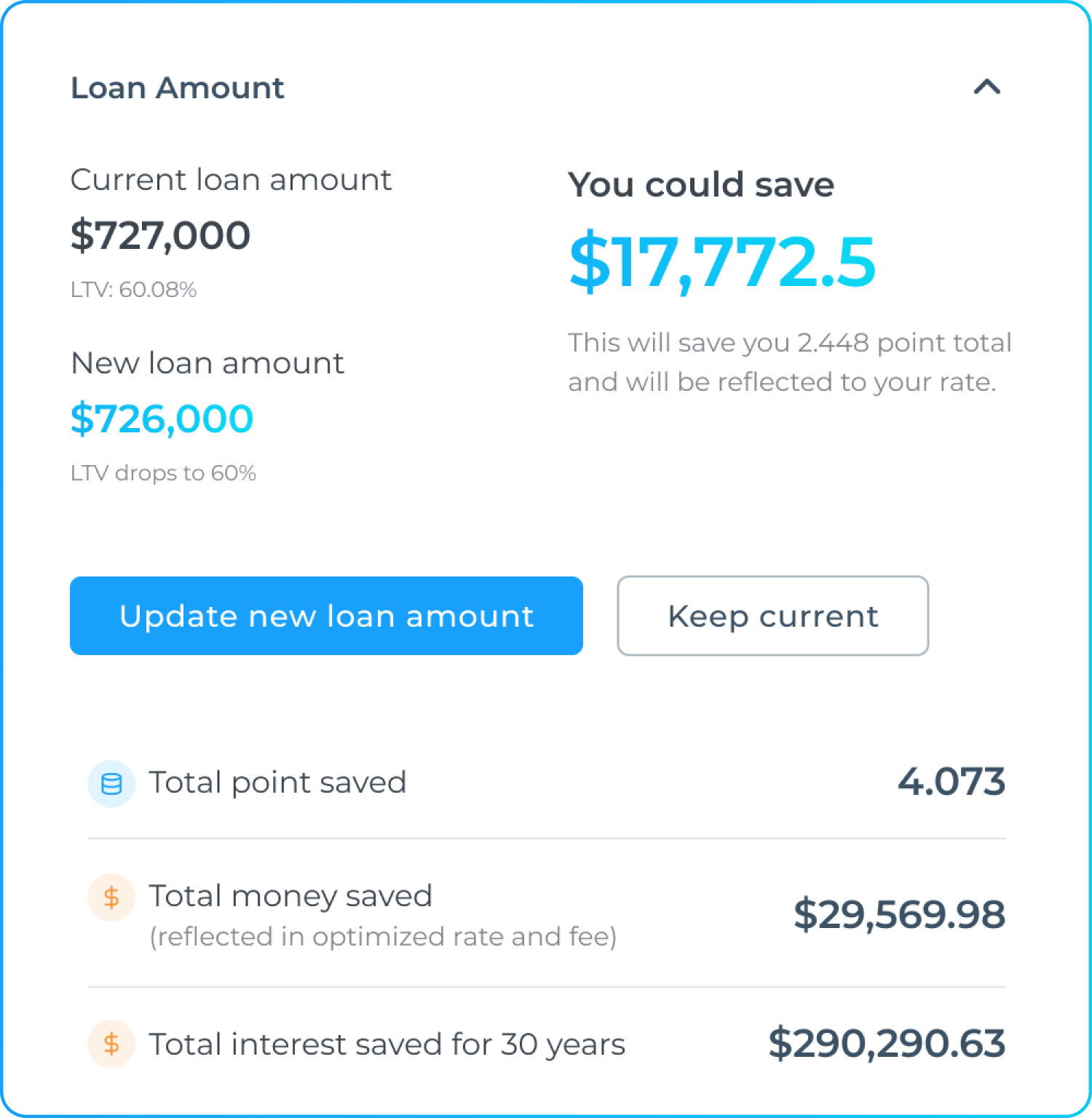

Rate Optimization

| Others | With AMO optimize | |

|---|---|---|

| APR | 6.753% | 6.378% Lower |

| Rate | 6.375% | 6.375% |

| Fee/ Credit | $29,506.49 | $183.84 |

| LTV/ FICO | 60.06% / 639 | 59.98% / 640 |

| Total point saved | 3.823 | |

| Total money saved | $29,284.18 | |

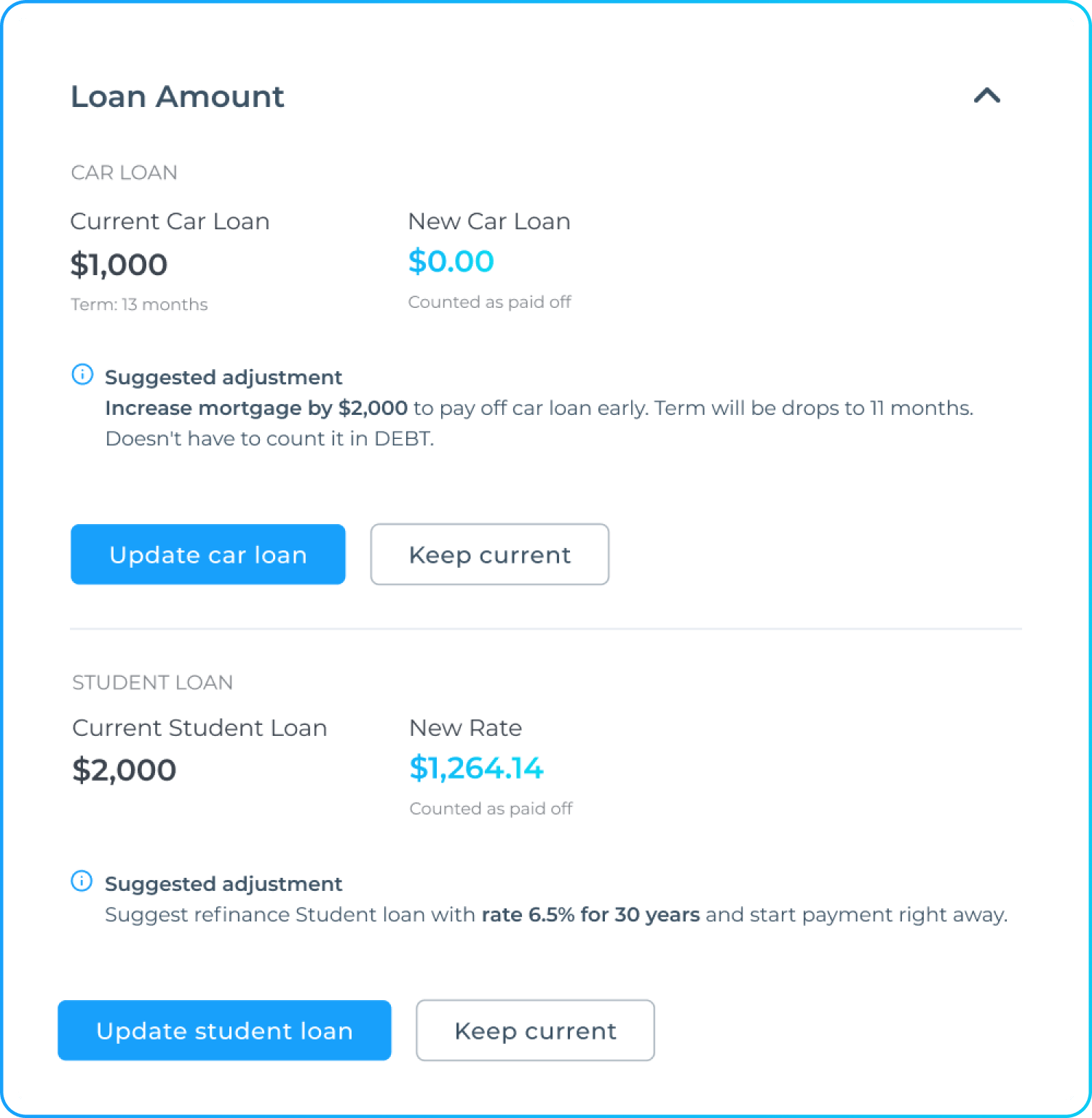

DTI Optimization

| Others | With AMO optimize | |

|---|---|---|

| Rate | 6.5% | 6.5% |

| Car loan | $1,000 | $0 |

| Student loan | $2,000 | $1,264.14 |

| Debt to Income Ratio (DTI) | 63.1% Failed | 47.8% Passed |

* To be qualified for a loan, Debt to Income Ratio(DTI) need to be less than 50%

Unlock smarter savings with

AMO rate optimization

Beyond lowering rates, we provide personalized pricing

advice to maximize your financial advantage and qualify for the loan.

We are an Advisory Mortgage Platform

AMO is an early-stage Silicon Valley fintech startup transforming the mortgage industry

by providing a user friendly end-to end loan origination platform with optimization tools to maximize borrowers' benefits.

Superior Choice

Picking the best out of 1000+ loan programs in a network of 50+ lending organizations.

Power by Robo mortgage advisor

Utilize technology to turn a US top 5 mortgage broker experience and knowledge into a Robo mortgage advisor.

More Saving

Getting the lowest rate that best matches your financial situation and interests

Accelerated by

Today Best Rates On Our Marketplace

Mortgage rate trends

How to get better mortgage rate than the ones available?

Are you still not satisfied after shopping for the lowest rate from hundreds of lenders ? Meet AMO Mortgage Platform. It utilizes advanced algorithms and mathematical rules to optimize your rates based on your multidimensional financial conditions such as equity, credit score, loan programs, loan terms, home usage, incomes and debts.

Best Rate from Lending Networks

(408) 444-8782#100

supports@oneamo.com

621 Tully Rd #125, San Jose, CA 95111

Contact us or book a meeting here:

© Wonder Rates, 2020. Equal Housing Opportunity. Equal Housing Lender. DRE#02047445. NMLS#1518655